delayed draw term loan ticking fee

These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

Delayed Draw Term Loan Ddtl Overview Structure Benefits

The fee amount accumulates on the portion of the undrawn loan until the loan is.

. Delayed draw term loans are structured in a way that it has the price paid from the debtor to the lender this price is known as the ticking fee. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. Tax perspec-tive however tax fungibility.

Delayed Draw Term Loan Lender means a Lender with a Delayed Draw Term Loan Commitment or an outstanding Delayed Draw Term Loan. How are Delayed Draw Term Loans Structured. Delayed Draw Term Loans February 13 2018 Time to Read.

This acronym stands for earnings before Interest lenders are sometimes able to include a closing condition that any material governmental consent required to execute and deliver the. Keep reading for more information about this unique form. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

Delayed Draw Ticking Fee. The Borrower shall pay to the Lender a delayed draw ticking fee a Delayed Draw Ticking Fee which shall accrue at the rate of 025 per annum on the. Delayed draw term loans are one way BDCs like Saratoga Investment Corp.

It can also be a component of a syndicated loan which is offered by a. Tion with larger term loans drawn on the closing date5 and if drawn are generally intended to be a fungible increase of the initial term loan. Delayed Draw Term Loans has the meaning.

Can meet the needs of small to medium-sized enterprises. However delayed draw term loans carry commitment fees which are based on the amount of unused facilities. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

This CLE course will discuss the terms and structuring of delayed draw term loans. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged. Unlike the ticking fee that is paid.

Typically these fees start at 1 and increase to 50 basis points for. After the loan is issued it tracks the same terms as the. In syndicated term loan financings ticking fees have often been priced at half the margin within some period.

The fee amount accumulates on the.

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

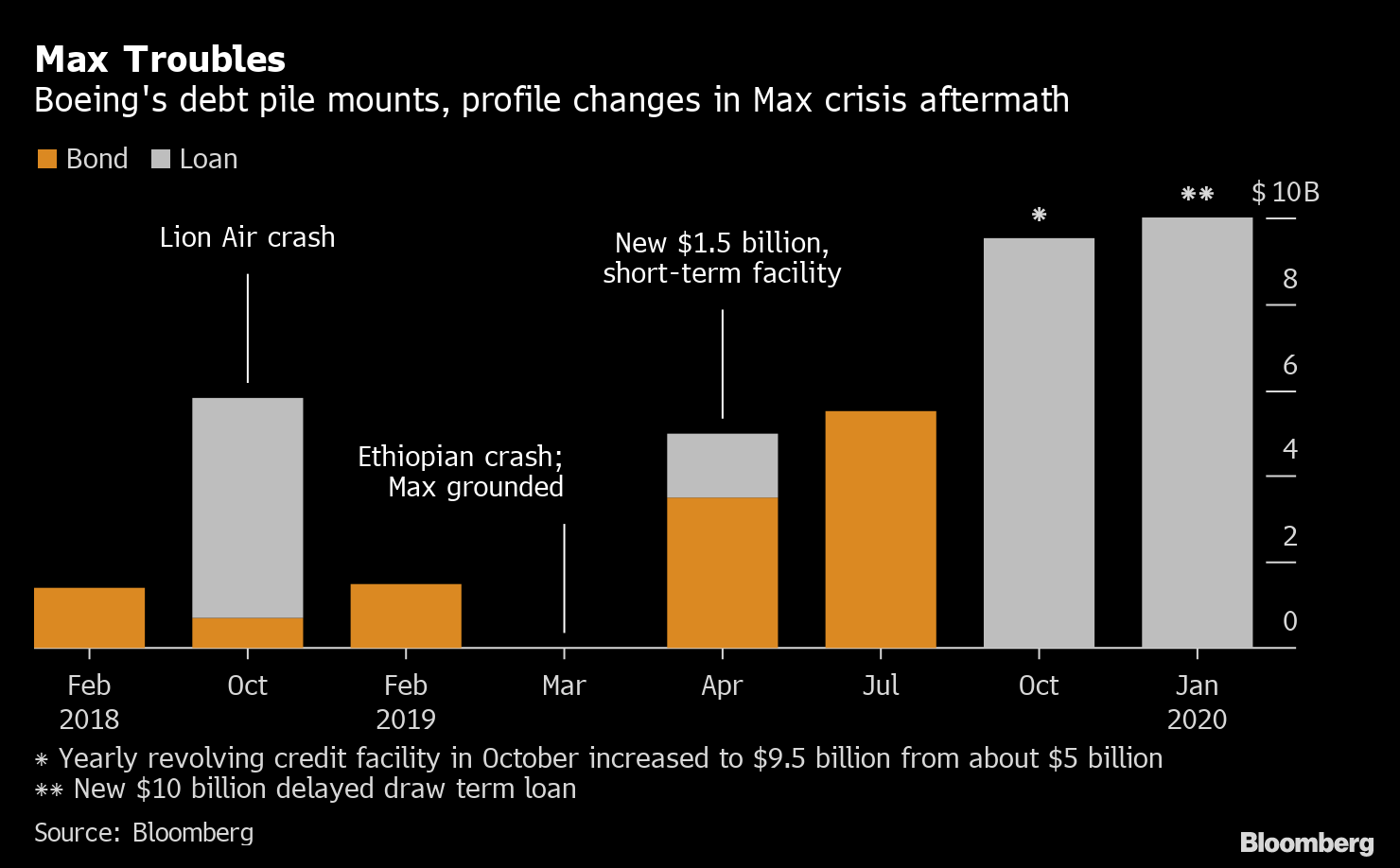

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg

Horizon Global Announces Successful Completion Of 225m Term Loan Facility Atlantic Park

Leveraged Loan Primer Pitchbook

First Amendment Dated As Of December 3 2018 Among Nsm Insurance White Mountains Insurance Group Ltd Business Contracts Justia

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

Leveraged Finance 1q 2018 Market Update Continued Sponsor Friendly Terms

Execution Version Deal Cusip 19933mae3 Revolving Loan Cusip 19933maf Law Insider

The Book Of Jargon European Capital Markets And Bank Finance

Execution Version Deal Cusip 19933mae3 Revolving Loan Cusip 19933maf Law Insider

Investor Hot Topics In Leveraged Loans Europe Vs Us 9fin Educational

Investor Hot Topics In Leveraged Loans Europe Vs Us 9fin Educational

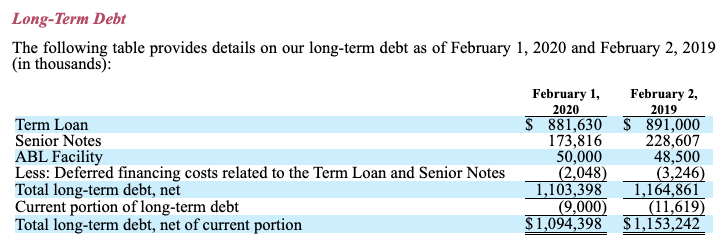

Retail Falls Retail Evolves Part I

Horizon Global Announces Successful Completion Of 225m Term Loan Facility Atlantic Park

:max_bytes(150000):strip_icc()/annabaluch-06bd4a2a204649b58c1b849e35dc2ec8.png)

What Is A Delayed Draw Term Loan Ddtl

:max_bytes(150000):strip_icc()/BioPhoto-CiM-c5d6f0fbdcd64f89aeba1441341bbcea.jpg)

What Is A Delayed Draw Term Loan Ddtl

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence